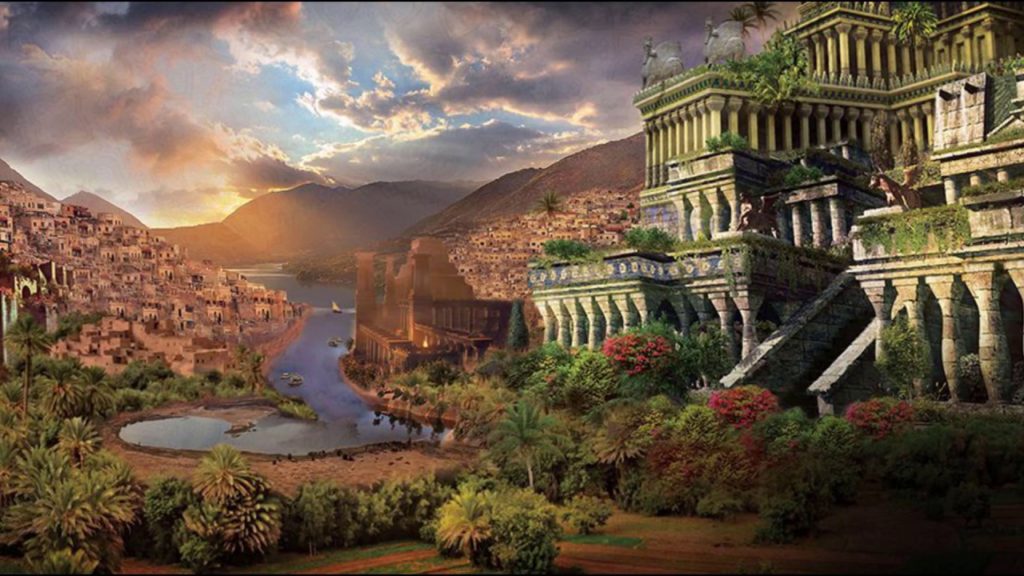

The Richest Man in Babylon is a classic personal finance review. Published in 1926, the book shares financial advice through parables set in ancient Babylon. The book’s characters learn simple finance through their experiences in business and finance.

Although it was published nearly 100 years ago, the book is still timeless. Their lessons are summarized below – if you follow their lessons, you’ll have millions over a lifetime.

Pay Yourself First

For every dollar that comes in, make sure you save that money first. The book recommends saving at least 10% of your income, and we recommend a minimum of 20% by following the 50/30/20 rule.

Pay yourself first and maximize your hierarchy of savings. The more you save, the higher your future net worth will be.

Spend Less Than You Earn

Nearly 50% of Americans spend more than they earn. Don’t follow the herd on this.

The FIRE movement has taken off to fight this, where followers save more money and say no to consumerism. FIRE stands for Financial Independence, Retire Early.

Spending less allows you to save more, and it gives your more free time from managing stuff. By not owning too much, you’ll have more time to focus on generating wealth.

Your Labor Will Never Make You Wealthy

You need to “make thy gold multiply”, or invest as much money as possible.

The wealthy are able to make most of their money off of investments in rental properties, stocks, or personal businesses. Do the same by investing as much as you can.

Guard Thy Treasures from Loss

Compounding interest works with time. The less money you lose, the more it will compound. A 10% return off $200k will yield twice as much money as 10% return on $100k.

This is why we recommend holding on to stocks for at least 5 years. This will account for cyclicality, and will ensure you realize your investing thesis.

Make Your Home a Profitable Investment

Don’t automatically assume that you should own a house instead of rent. Make sure you’re paying the right price for where you live. You’ll be house poor if all your income gets tied to your mortgage payment.

Also, find ways to make money off of your home. By collecting rent or deducting space for a home office, you’ll be able to treat your home as an investment.

Insure a Future Income

You’ll never be younger than the moment you read this. You will get older, and will have more family obligations.

By investing as much as you can now, you’re setting yourself up with a great income stream in the future. Save as much as you can now.

Invest In Yourself

Learn as much as you can to increase your future income. Take classes, read, exercise, and eat healthy.

While you should maximize your savings, there are things that are worth paying for. By investing in yourself, you’ll increase your salary and future job prospects. Furthermore, investing in your health now will save you a lot of health care costs later.

The Richest Man in Babylon Review – The Bottom Line

The Richest Man in Babylon is a classic review about the basics of personal finance. It came out in 1926, and the stories are as relevant now as they were then.

By paying yourself first, investing in yourself, and maximizing your savings, you’ll set yourself for an amazing financial future. Make sure to keep these in mind, and make sure to revisit this for an occasional refresher.