It’s important to know the future value of your savings when you build a budget. A simple way to keep this in mind is to know your opportunity cost of saving.

What is Opportunity Cost?

Opportunity cost is a key concept of economics, which represents the scarcity of choice. You only have so much time and money, and opportunity costs are the costs incurred by not enjoying the benefit from your next available choice.

When you build a budget, your opportunity cost is the cost of enjoying a dollar now versus saving that dollar for later. A dollar invested today will be worth a lot more in 10 years thanks to compound interest, and that lost amount is your opportunity cost.

Opportunity Cost Examples

Let’s suppose you have free tickets to see Elton John. On the night of the concert, you find out that Lady Gaga is making a surprise performance and the tickets are $100. Lady Gaga is your favorite artist, and you’re willing to pay $200 to see her perform. What is your opportunity cost of watching Elton John instead?

Answer – $100. You believe Lady Gaga’s performance is worth $200 in value, and you will only have to pay $100 to see her. Since you saw Elton John instead, you gave up $100 in opportunity cost.

Another example is with the play Hamilton, which was a smash hit in 2015. Tickets in San Francisco were on sale for $200, and the resale value was upwards of $1,000.

Many people who saw Hamilton believed that they were giving up just the $200 they paid. Since the market value of the ticket was $1,000, their true opportunity cost that was given up was $1,000.

How Does Opportunity Cost Apply to Build a Budget?

The same logic can be applied to building a budget. Imagine you wanted to buy a pair of jeans for $100. If you just look at the value of that money today, your opportunity cost for that pair of jeans is $100.

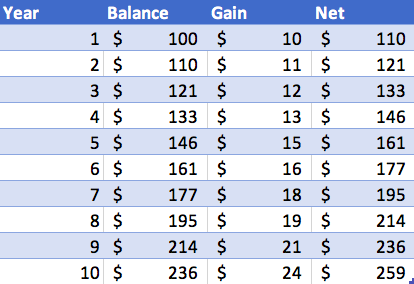

But what if you invested that $100 in an index fund instead? Since the S&P 500 averages a 10% return per year, what would that $100 be worth 10 years from now?

After 10 years, that $100 will be worth $259, over 2.5x the initial number. That’s a much bigger sacrifice, and should help you re-evaluate whether that pair of jeans is worth what you’re giving up.

The 2.5x rule applies as your spend goes up. When purchasing a $50k car, your 10 year opportunity cost would be $130k. This is a little over the 2.5x multiple of $125k. Due to this, we recommend spending as little as possible on a car.

This adds up with rent as well. While owning a home is a key contributor to building net worth, it may not be possible for those of us who live in the coast. I personally live in San Francisco, and am spending as little as possible on rent to make up for not owning a home.

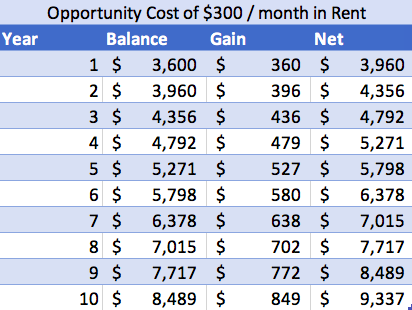

What if you’re evaluating two places to rent, and the price is only $300 different? Since the average rent in San Francisco is $3,500 per month, $300 per month is only a 8.5% difference. How much does that add up?

It turns out, that $300 per month is over $9,000 over 10 years if you live at the more expensive apartment for just one year.

Opportunity Cost – The Bottom Line

Make sure you consider the full opportunity cost as you build your budget. Had you saved that $100 that you were going to spend on a pair of jeans, it would have become $259 over 10 years. Keeping this in mind will help you save more money, and will dramatically improve your net worth over time.

Warren Buffett always had this mindset. The book Buffett: The Making of an American Capitalist, Warren’s wife once spent a bunch of money on home decorations. Warren vented about this with a friend, stating how much that money would have been had he invested it instead.

Follow a similar mindset towards opportunity cost, it will pay major dividends as time goes by.