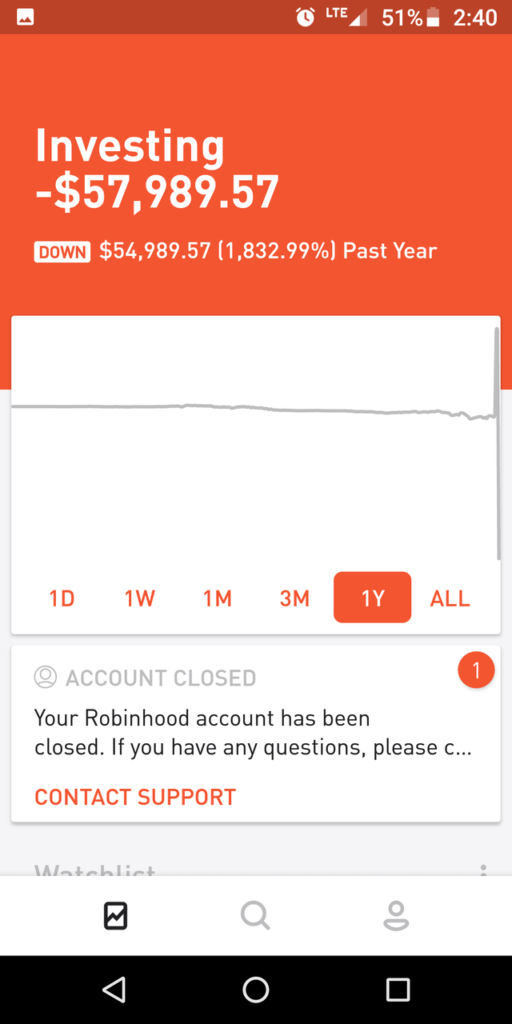

Reddit users on Wall Street Bets are famous for turning a lot of money into nothing, and 1RONYMAN upped the ante by realizing a -1,833% loss, turning his $5k investment into -$58k.

His loss has been memorialized here, and a summary of his losses are in the image below:

What is a Box Spread?

When trading options, a box spread is a combination of positions that has a certain, or riskless payoff.

For example, suppose you have a bull spread from calls (long a $100 call, short a $150 call) combined with a bear spread of puts (long a $150 put, short a $100 put) has a fixed payment of the difference in exercise prices.

The idea is that no matter what price the stock is, you’re on the hook for the same amount of money.

If you long a $100 call and long a $150 put, and the stock is trading for $120. Your calls are $20 in the money, while your puts are $30 in the money, making you $50 total.

Conversely, the $150 call you shorted will be $30 out of the money, and your $100 put will be $20 out of the money, losing you $50 as well. Everything should net out in the end, and in the meantime you made money arbitraging the original option prices.

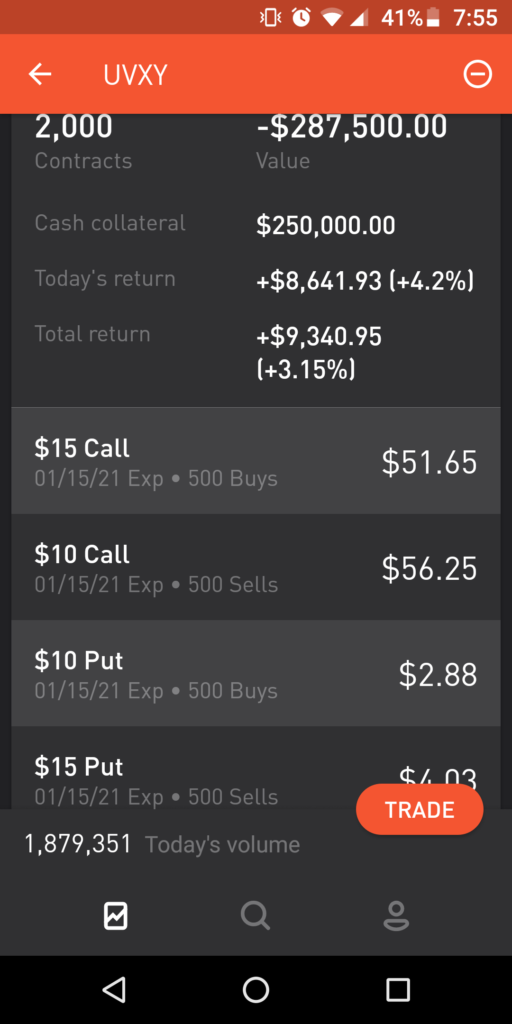

1R0NYMAN showed the box spread that turned into -$58k in a separate Reddit post on Wall Street Bets:

What Happened to 1R0NYMAN?

At face value, it looks like 1R0NYMAN did all the right things to minimize risk. The bull spread is a long $10 call and a short $15 call. While the bear spread follows suit with a long $15 put, and a short $10 put. So what happened?

If 1R0NYMAN scrolled down far enough, they would have seen one comment that would have saved them sixty thousand dollars:

“Google American options. What do you think happens if all 500 calls are exercised on you?”

CHAINSAW_VASECTOMY

1R0NYMAN forgot that these are American options, and the trades can be executed at any time. The stock, UVXY, is trading for roughly $50 per share. This means that those $15 call options are severely in the money.

Since the options are in the money, the holders cashed in on their calls. Once this occurred, 1R0NYMAN was on the hook to redeem those shares. The $5k investment turned into -$58k in a near instant.

American Options vs European Options

European options can only be exercised at the strike date, while American options can be exercised at any time. Option owners prefer American options for this flexibility.

The exercised options blew up 1R0NYMAN’s equity base, and the net loss cratered past rock bottom. As one Reddit user pointed out, it’s fortunate that Robinhood closed the account when they did. If not, 1R0NYMAN could have been on the hook for a lot more money.

The Bottom Line – Turning $5k into -$58k on Wall Street Bets

Many readers praised 1R0NYMAN’s box spread strategy in the original post, impressed that $5k could make $35k of “riskless profit”. Had 1R0NYMAN scrolled down far enough, they may have realized how much risk they were truly taking on.

When it comes to investing, welcome opposing viewpoints. Keep reaching out to people or scrolling down sites to find why an investment won’t work. If the entire crowd agrees with you, there could be a problem.

This is especially true with any “riskless profit” opportunities. If an investment is truly risk-free, hedge funds will catch them before you have a chance to make money off of it. Billions of dollars are spent on machines and technology to find these arbitrage opportunities.

If something appears risk-free, ask yourself why no professionals have exploited the opportunity. With enough digging, you should find your answer.

Finally, this hopefully serves as another reminder to not use Wall Street Bets for investment advice, unless you are comfortable turning $5k into -$58k. They’re a great place for entertainment, but their investment knowledge is pretty hollow.