The personal finance industry is filled with sound bites and one-liners that sound good without making an impact.

Below are five pragmatic personal finance hacks that will move the needle. These aren’t easy, but if they were, everyone would be rich.

Live Below Your Means

Once you make a certain amount of money, there is nothing easier than living below your means. Everything above your basic needs is mostly for your ego and social climbing, so stay modest to keep building your wealth.

When you think about people’s income and ego, you can see why people save so little. Your ego can devastate your finances by making you house poor, or by making you fall victim to lifestyle inflation.

Don’t worry about how others think about you. As the popular saying goes “money talks, wealth whispers”.

Have a Partner Who Also Lives Below Their Means

A high spending partner can devastate all the progress you made by living modestly and saving. Be pragmatic about who you’re dating, and keep an eye on their spending and saving habits.

Financial disputes are one of the leading causes of divorce, and divorces are the greatest wealth destroyer you can face. Drop these relationships before they become toxic to your health and finances.

Have a Career that Pays Well

Have you ever noticed how most people who say to follow your passion are already rich?

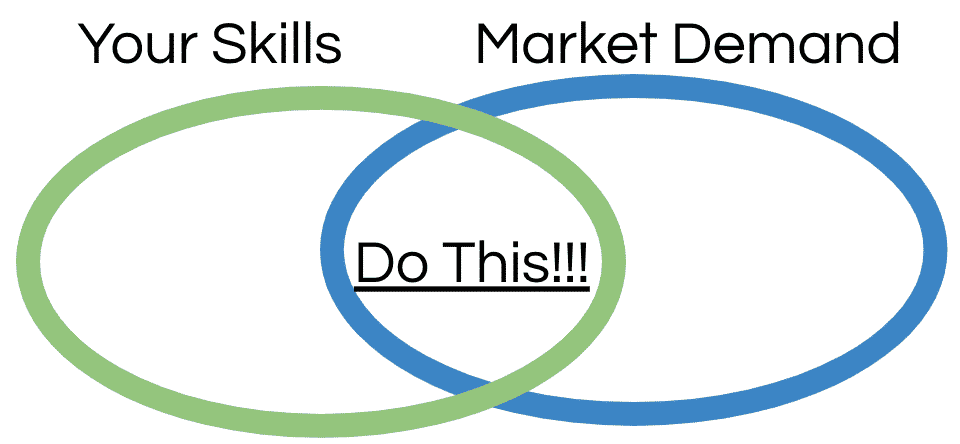

Instead of following your passion, find a passion that’s a blend between what you’re good at, and what the job market needs.

Focusing on this will make you happy and will pay you handsomely. As you save that money in your hierarchy of savings, you’ll have more financial flexibility to focus on other hobbies and passions.

Be Patient About Your Career and Personal Finances

Your career and investments will take time to materialize. Thanks to the power of compounding, the more you invest now will pay off major dividends years down the road.

Unfortunately, too many of us are looking for short-term gratification. When you sell a stock too soon for a quick gain, you could lose an infinite return, as we showed with the Amazon example.

In all fairness, it’s hard to be patient when we see friends getting promoted faster than we are. Same goes for investing.

Just remind yourself that there will always be people who could be promoted faster than you, and who may have invested in a company that is having a better run at the moment.

That’s okay, just keep focusing on investing in yourself, and the returns will come.

Use Free & Cheap Resources

Don’t waste your money on a gym membership, and instead use outdoor parks. Same goes for using the library instead of buying books.

Other examples include going to a public school, or capitalizing on in-state tuition. All of these savings will go straight to your net worth.

Personal Finance Tips – The Bottom Line

There are a lot of one-liners from personal finance gurus about cutting coffee or avocado toast. While these are simple to do, they aren’t going to move the needle for your savings.

Live below your means, pick the right partner, find a high paying career, be patient, and use cheap resources when you can. All five of these personal finance tips will make a massive impact on your expenses.

Unfortunately, none of these personal finance tips are easy. Just remember that if getting rich was easy, everyone would be. In the meantime, keep doing the right things, and enjoy your coffee.